Richard T. Watson (University of Georgia, GA, USA), Stefan Seidel (University of Liechtenstein, Vaduz, Liechtenstein), and Katharina Drechsler (University of Liechtenstein, Vaduz, Liechtenstein)

In the blog on “Capital Creation and Organizational Innovation,” you learned that all organizations are in the business of creating capital. Because of the competitive nature of a market economy, most enterprises need to continually transform their capital creation model to retain a compelling value proposition for their customers.

An examination of the automotive industry from Ford to Tesla illustrates how capital creation metamorphizes over time, as depicted in the following table. All automotive companies create economic capital, a vehicle they can sell, but the focus and composition of the capital creation system can vary.

Table 1: The shifting focus of the car industry

| Company | Product focus | Capital focus |

| Ford | Scale | Economic |

| GM | Choice | Organizational |

| Toyota | Quality | Human |

| BMW | Prestige | Symbolic |

| Tesla | Connectivity | Organizational |

Ford

Henry Ford famously offered his customers, “a car painted any color that he wants so long as it is black.” Thus, Ford’s Model T constituted the first car marketed to the average family. Ford focused on economic capital as the prime success factor. This emphasis is embodied in the River Rouge Complex, which was, when completed in 1928, the world’s largest integrated factory employing at its peak around 100,000 people. For Ford, his system of production, the assembly line, was the central concern.

General Motors (GM)

When Alfred Sloan became president of GM in 1923, his strategic goal was to produce a car “for every purse and purpose,” and annually each GM model was revised to meet changing needs and also to ensure that models did not compete with each other. Thus, the Chevrolet division manufactured and marketed to those buyers seeking an inexpensive car, whereas Cadillac catered for the most affluent. This strategy also allowed GM to secure customers’ loyalty as their preferences and buying power changed. When Sloan took over at GM, Ford had a market share of around 60%, compared with GM’s 12%. By 1927, GM’s sales overtook and exceeded Ford’s, as is still the case.

Sloan acquired a skilled management team to determine what models to produce for each market segment. Operating a more complex multidivisional firm and annual strategic planning required the creation of organizational capital. He recognized that this was the core competency of his economic capital creation system when he said, “Take my assets—but leave me my organization and in five years I’ll have it all back.” Annually, his strategic planning meetings defined the market in terms of models and their features, and differentially marketed to the various target segments (purpose and purse).

Toyota

In the 1970s, Ford and GM were outsmarted when Japanese carmakers, in particular Toyota and Honda, entered the US car market with a different capital conversion model for the automotive industry. Their model enabled them to offer consumers a better deal in terms of quality and cost. While lean production certainly played a part, there was another key factor: human capital.

Japanese companies aim to maximize the utilization of their human resources, resulting in higher productivity, lower employee turnover, and less absenteeism. They focus on recruiting quality workers who will assimilate readily into the company culture and encourage them to stay. They create a strong lifetime social bond between employees and the firm, which facilities teamwork and cooperation. The emphasis on human capital includes the continuous development of employees’ skills. The Japanese automakers demonstrated that high-quality human capital could build more reliable and durable cars at a lower cost. The best Japanese auto workers were at one point twice as productive as their US counterparts. The quality of Japanese auto imports inflicted lasting damage on the US automakers. Currently,[1] the market capitalization of GM and Toyota are USD 34 billion and USD 202 billion, respectively.

Human capital was the new foundation for competition in the vehicle manufacturing business. Toyoda Sakichi, the founder of Toyota Industries Corporation and father of Toyoda Kiichirō, who founded Toyota Motor Corporation, noted, “Workers are [the] treasure of the factory. They are important to me.” The Japanese model views human capital as the key success factor in the creation of economic capital. It is complemented by organizational and economic capital.

BMW

BMW is one of the most profitable automotive companies. Indeed, the luxury segment of the automotive industry produces about 12% of the vehicles and 50% of the profits. BMW, and its competitors in the prestige auto market, excel at creating symbolic capital. BMW cars are high quality and built to emphasize the joy of driving, but not always the best in the market. Consumers pay extra because of the symbolic capital embedded in the BMW brand.

In 1992, Chris Bangle became BMW’s design chief. He directly connects car design with art. He states, “A car designer is really a sculptor. Cars are the sculptures of our everyday lives. We at BMW do not build cars as consumer objects, just to drive from A to B. We build mobile works of art.” His focus on bold design complemented the ‘ultimate driving machine’ slogan BMW had introduced two decades prior. Symbolic capital generates much of the profits in today’s car industry.

Tesla

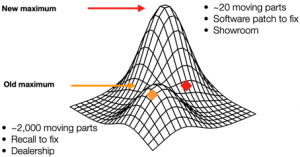

Tesla standouts for its mass production of electric vehicles, but it is also transforming the capital creation model of the automotive industry in three major ways, as shown in the following figure.

Figure 1: Tesla’s new automative industry mountain

First, an electric car is less complex, with about 1% of the moving parts found in a car with an internal combustion engine. Consequently, manufacturing, maintenance, and repair are simpler. An electric vehicle does not need an oil change.

Second, Tesla builds connected cars that stream data to its servers and whose software can be updated remotely. Tesla knows more about its customers and their driving behavior than any other auto maker. Furthermore, when a fix is needed, such as improving the braking system after an adverse report by the U.S. Consumers’ Union, Tesla transmits a software fix to its cars rather than undertaking an expensive recall and inflicting inconvenience on its customers.

Third, Tesla is also altering the selling of cars in many countries. The traditional dealership with sometimes hundreds of cars on the lot is expensive and totally at odds with a just-in-time manufacturing system focused on cost reduction. Tesla takes orders, either from its small showrooms or online. It deals directly with customers.

Tesla’s success is based on new forms of organizational capital, software for connected cars and software to deal directly with customers in maintaining and selling cars. In contrast, the car dealership model is an old form of organizational capital that makes little sense in a digital world. This legacy widely persists because vested interests can be a friction that retards the reinvention of capital creation models.

Overall, we envision the automotive industry located in a business environment where the various players compete to climb a local productivity mountain. Over time, Ford, GM, Toyota, and BMW competed to climb the same mountain, but Tesla has identified a new mountain with a higher peak, as a result Tesla now has a market capitalization of USD 105 billion—about half of Toyota’s—while manufacturing less than half a million cars per year, whereas in 2019 Toyota made almost nine million cars.

Commentary

Henry Ford, Alfred Sloan, Sakichi Toyoda, Chris Bangle, and Elon Musk have distinct signature achievements that resonate with their view of capital creation. The River Rouge Complex asserts that economic capital is the main input for creating more capital. The multidivisional corporation, organizational capital, was Sloan’s enduring emblem. For Toyota, it is dedicated and well-trained employees who can manage lean production and quality control. Bangle realized that customers are willing to pay a premium to be associated with a distinctive and status conferring design. Elon Musk is reinventing the century old auto business by changing both the driving platform and the customer relationship. As he observes, “If you’re trying to create a company, it’s like baking a cake. You have to have all the ingredients in the right proportion.”

All organizations require a mix of the six types of capital—economic, organizational, human, social, symbolic, and natural—to varying degrees. Deciding on the complementary blend and point of focus determines capital productivity, but this blend is not static. It changes with new technology and varying customer needs. Restructuring an industry’s capital creation system, shifting the focus, and seeing a new mountain often induces radical change and higher levels of capital productivity.

Key insights

- Within an industry, innovation in one member’s capital creation system can reshape long-term market share and profitability.

- An organization’s capital creation system needs to be clearly understood and frequently reviewed to identify competitive innovations in the blending of the various forms of capital to accommodate changes in customers’ tastes and technology.

[1] 2020-04-10

22 comments on “The Transformation of Capital Creation in the Automotive Industry”

Comments are closed.